3QFY2019 Result Update | Auto Ancillary

February 13, 2019

Automotive Axles

BUY

CMP

`1109

Target Price

`1450

Investment Period

12 Months

Performance Update

Quarterly (` cr)

Q3FY19

Q3FY18

% yoy Q2FY19

% qoq

Stock Info

Net sales

486

408

19%

498

-3%

Sector

Auto Ancillary

EBITDA

56

44

26%

59

-5%

Market Cap (` cr)

1,676

Net Debt (` cr)

-

EBITDA margin (%)

11.5%

10.8%

63

11.8%

-97

Beta

0.9

Adjusted PAT

30.39

21.19

43.4%

32.00

-5%

52 Week High / Low

1820/991

Avg. weekly Volume

4,014

In Q3FY2019, on standalone basis, revenue of Automotive Axles Ltd. (AAL) was up 19%

Face Value (`)

10

yoy at

`486cr despite the slowdown in commercial vehicles during the quarter.

BSE Sensex

36,153

However, on qoq basis, revenue was lower by 3%. OPM improved by 63bps yoy to

Nifty

10,831

Reuters Code

ATOA.BO

11.45% on account of better utilization, EBIDTA was higher 26% yoy to `56cr as

Bloomberg Code

ATXL IN

compared to `44cr in Q3FY2018. Profit for Q3FY2019 increased to `30cr on the back

of stable depreciation cost, which aid PAT growth of 43% to `30cr yoy basis. All in all,

Shareholding Pattern (%)

Promoters

71.0

for the quarter under review, Automotive Axles has delivered good performance in a

MF / Banks / Indian Fls

8.9

tough environment where the sales and production of OEMs has remained flat.

FII / NRIs / OCBs

1.4

Indian Public / Others

18.7

For 9MFY2019, AAL has reported 34% yoy growth in top-line to

`1,458cr from

Abs.(%)

3m

1yr

3yr

`1,084cr in 9MFY2018. Operating profit also improved by 53% yoy to `171cr as

Sensex

(4.1)

6.3

26.7

against `112cr in 9MFY2018. OPM improved by 140bps to 11.7% yoy vs. 10.3%

Automotive Axles

(22.1)

(35.6)

52.5

during the same period last year on account of improving utilization on various cost

efficiency measures. Profit came in higher by 65% yoy `92cr as against `52cr in

9MFY2018.

We expect, AAL’s revenue to register 30% CAGR over FY2018-20E to `2,584cr and PAT

to grow at 31% CAGR during the same period to `147cr.

Going forward, we expect utilization to improve further on account of increasing

demand in M&HCV and LCV segments; further availability of finance will also improve

the sentiment in the industry.

Key things to watch for: (1) Growth in revenue from slip suspension, (2) Capacity

utilization and expansion plans, and (3) Increasing pie from export revenue.

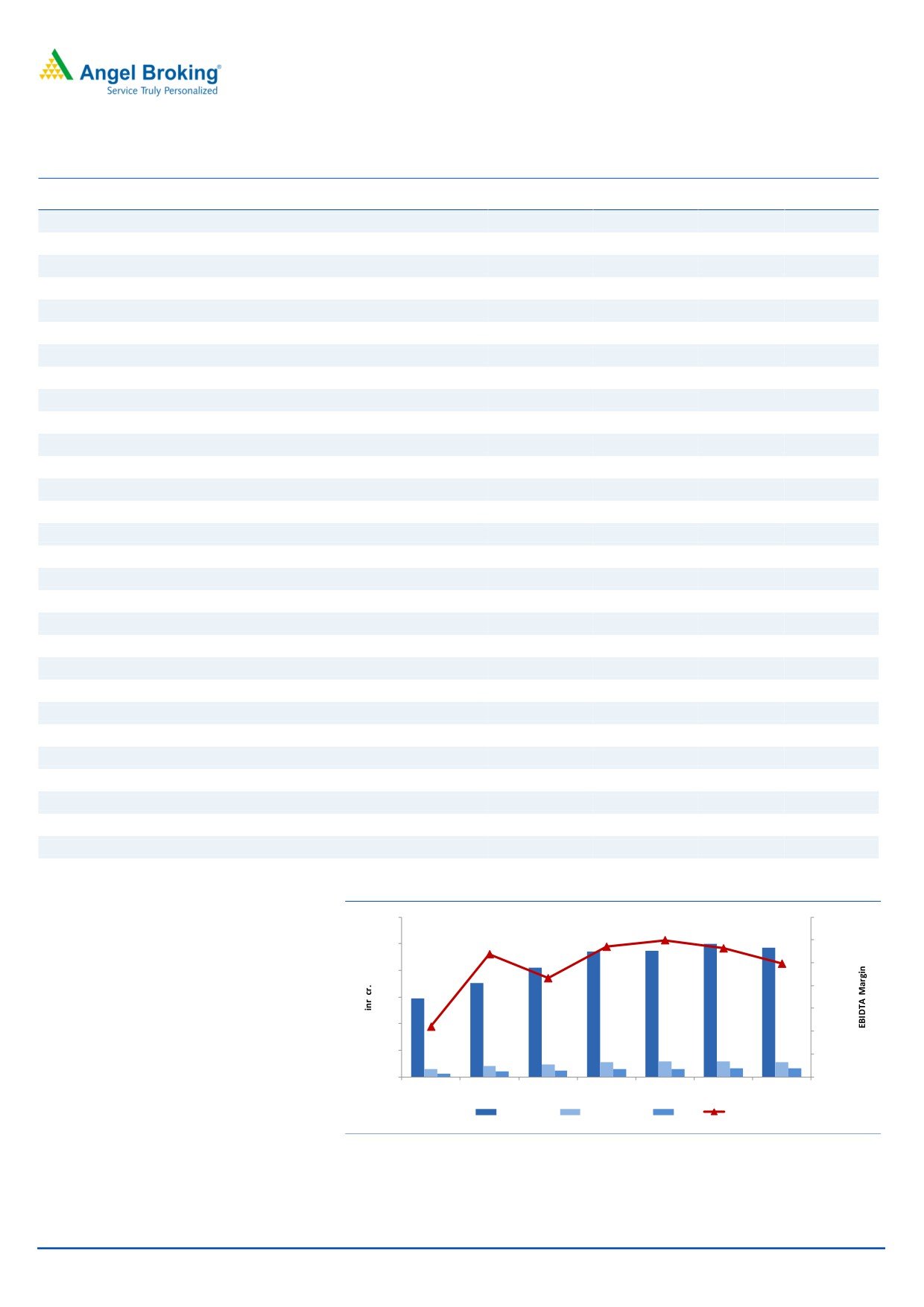

3years performance chart

2,000.00

Outlook & Valuation: We believe AAL is comfortably placed to tap the upcoming

1,500.00

opportunity in the industry owing to improving road infra, BS-VI pre-buying and foray

into new segments coupled with expansion of capacity by 35-40%. At the CMP of

1,000.00

`1,109, the stock is available at 12x its FY2020E EPS of ` 97. We have assigned a

multiple of 15x and recommend BUY on AAL with a Target Price of `1,450, implying an

500.00

upside of 30%.

0.00

Key Financials

Y/E March (` cr)

FY17

FY18

FY19E

FY20E

Net Sales

1,172

1,519

2,070

2,584

Source: Company, Angel Research

% chg

8

30

36

25

Net Profit

49

84

128

147

% chg

42

70

52

15

EBITDA (%)

9.7%

11.0%

12.0%

10.8%

EPS (Rs)

33

56

84

97

P/E (x)

34

20

13

11.4

P/BV (x)

4.4

3.8

3.0

2.5

RoE (%)

13.1

18.9

23.2

21.8

RoCE (%)

19.7

27.9

32.3

29.2

Kripashankar Maurya

EV/EBITDA

14.4

9.8

6.2

5.4

022-39357800 Ext: 6004

Source: Company, Angel Research

Valuation done based on 12th February, 2019 closing price

Please refer to important disclosures at the end of this report

1

Automotive Axles | 3QFY2019 Result Update

3QFY2019 Performance

In Cr

Q3FY19

Q3FY18

Q2FY19

YOY %

QOQ%

Net Sales

486

408

498

19%

-3%

Total Income

486

408

498

19%

-3%

Total Expenditure

430

364

440

18%

-2%

Raw Material Consumed

396

292

350

36%

13%

Stock Adjustment

-60

-7

-10

NA

NA

Purchase of Finished Goods

0

0

0

NA

NA

COGS

335

284

340

18%

-1%

Employee Expenses

32

28

31

11%

1%

% of sales

0

0

0

Other Expenses

63

51

68

24%

-7%

As a % of sales

13%

12%

14%

Raw Material Consumed

81%

71%

70%

Stock Adjustment

-12%

-2%

-2%

Purchase of Finished Goods

0%

0%

0%

COGS

69%

70%

68%

Gross Margin %

31%

30%

32%

Other Expenses

13%

12%

14%

EBITDA

56

44

59

26%

-5%

Other Income

0.72

1.2

0.9

-38%

-17%

Interest

0.15

0.1

0.2

28%

-23%

PBDT

56.19

45.19

59.45

NA

-5%

Depreciation

11.45

12

12

-2%

-7%

PBT

44.74

33.56

47.20

33%

-5%

Tax

14.35

12

15

16%

-6%

PAT

30

21

32

43%

-5%

Ratios

BPS

BPS

EBITDA margin (%)

11.45%

10.83%

11.79%

63

-34

PAT margin %

6.26%

5.20%

6.42%

106

-16

Tax rate %

32.08%

36.85%

32.21%

-478

-13

Quarterly performance charts

600

12.50%

498

486

470

475

12.00%

500

409

11.50%

400

351

294

11.00%

300

10.50%

200

10.00%

100

56

57

59

56

41

46

9.50%

30

20

22

28

29

32

31

13

0

9.00%

Q1FY18

Q2FY18

Q3FY18

Q4FY18

Q1FY19

Q2FY19

Q3FY19

Sales Rs. Cr.

EBIDTA Rs. Cr.

PAT

Margin

Source: Company, Angel Research

February 13, 2019

2

Automotive Axles | 3QFY2019 Result Update

Income statement

Y/E March (` cr)

FY17

FY18

FY19E FY20E

Total operating income

1,172

1,519

2,070

2,584

% chg

8

30

36

25

Total Expenditure

1,059

1,352

1,821

2,304

Raw Material

826

1,079

1,449

1,809

Personnel

81

99

124

155

Selling and Administration Expenses

21

23

31

41

Others Expenses

130

151

217

299

EBITDA

114

167

248

280

% chg

20

47

49

13

(% of Net Sales)

9.7%

11.0%

12.0%

10.8%

Depreciation& Amortisation

39

43

54

51

EBIT

74

124

194

229

% chg

33

67

57

18

(% of Net Sales)

6

8

9

9

Interest & other Charges

1

1

5

11

Other Income

2

5

5

5

Recurring PBT

75

128

194

223

% chg

46

70

52

15

Tax

26

44

67

77

PAT (reported)

49

84

128

147

% chg

42

70

52

15

(% of Net Sales)

4.2

5.5

6.2

5.7

Basic & Fully Diluted EPS (Rs)

33

56

84

97

% chg

42

70

52

15

Source: Company, Angel Research

February 13, 2019

3

Automotive Axles | 3QFY2019 Result Update

Balance sheet

Y/E March (`cr)

FY17

FY18

FY19E

FY20E

SOURCES OF FUNDS

Equity Share Capital

15.1

15.1

15.1

15.1

Reserves& Surplus

361

429

535

657

Shareholders Funds

377

444

550

673

Total Loans

-

-

51

111

Other Liabilities

3

2

0

0

Total Liabilities

379

446

602

783

APPLICATION OF FUNDS

Net Block

146

118

125

116

Capital Work-in-Progress

7

17

7

0

Investments

-

6

8

10

Long Term Loans & Advances

15

21

17

34

Current Assets

393

570

824

1,094

Inventories

99

137

170

198

Sundry Debtors

231

350

471

566

Cash

35

44

176

287

Loans & Advances

1

1

1

1

Investments & Others

27

37

6

41

Current liabilities

182

285

379

472

Net Current Assets

211

285

445

622

Other Non Current Asset

-

-

-

-

Total Assets

379

446

602

783

Source: Company, Angel Research

February 13, 2019

4

Automotive Axles | 3QFY2019 Result Update

Cash Flow

Y/E March (`cr)

FY17

FY18

FY19E

FY20E

Profit before tax

75

128

194

223

Depreciation

39

43

54

51

Change in Working Capital

(35)

81

(0)

(30)

Interest / Dividend (Net)

1

1

5

11

Direct taxes paid

26

44

67

77

Others

(9)

(245)

(139)

(88)

Cash Flow from Operations

97

51

181

244

(Inc.)/ Dec. in Fixed Assets

(23)

(30)

(49)

(39)

(Inc.)/ Dec. in Investments

1

3

(2)

(2)

Cash Flow from Investing

(23)

(27)

(51)

(41)

Issue of Equity

-

-

-

-

Inc./(Dec.) in loans

-29

-

51

60

Others

(11)

(15)

(49)

(151)

Cash Flow from Financing

(40)

(15)

2

(92)

Inc./(Dec.) in Cash

35

9

132

111

Opening Cash balances

0

35

44

176

Closing Cash balances

35

44

176

287

Source: Company, Angel Research

Key Ratio

Y/E March

FY17

FY18

FY19E

FY20E

P/E (on FDEPS)

34

20

13

11

P/CEPS

15

10

7

6

P/BV

4

4

3

2

EV/Sales

1

1

1

1

EV/EBITDA

14

10

6

5

EV / Total Assets

3

2

2

1

Per Share Data (Rs)

EPS (Basic)

33

56

84

97

EPS (fully diluted)

33

56

84

97

Cash EPS

75

113

163

180

DPS

8

14

14

14

Book Value

249

294

364

445

Returns (%)

ROCE

20

28

32

29

Angel ROIC (Pre-tax)

22

33

47

47

ROE

13

19

23

22

Turnover ratios (x)

Inventory / Sales (days)

31

33

30

28

Receivables (days)

72

84

83

80

Payables (days)

53

62

60

60

Working capital cycle (ex-cash) (days)

50

55

53

48

Source: Company, Angel Research

February 13, 2019

5

Automotive Axles | 3QFY2019 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER:

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National Commodity &

Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and Investment Adviser with

SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered entity with SEBI for Research

Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not

been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its

associates/analyst has not received any compensation / managed or co-managed public offering of securities of the company covered

by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Disclosure of Interest Statement

Automotive Axles

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or

No

relatives

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

February 13, 2019

6